A Decade of Women Supporting Women: Reflections on the 2023 Women’s Venture Summit

Pictured from left to right: Vanessa Small PhD, MBA, Lindsey Head, MBA, CFO, COO, Lianè Thompson, Brooke Barrett (BenchK12 Founder and CEO), Julie Castro Abrams, and Naseem Sayani. (Credit: Women’s Venture Summit)

I’ll admit, I was a little hesitant to attend my first Women’s Venture Summit. Though I knew I should be driving hard at our company’s raise goals, lately I had been pretty burnt out on the whole pitch scene. Instead, I had been focusing on how to make our team stronger, our product better, and how we can serve more educators and states faster. So, while the ethos of the summit was enticing, I worried about getting sidetracked from my goals for our company.

Still, I made it a priority to attend since new friends Sara Russick and Christy Johnson (shout out to the midwest!) had spoken so highly of this event and its organizers, We Are Stella led by the positive powerhouses Flossie Hall and Dr. Sylvia Mah. What I didn’t realize was that this was the ten-year anniversary of the summit, which served as an important milestone for reflection on women founders, investors, and funds.

For me, and so many other women I spoke to, this summit came right on time. Many of us shared the same exhausting and soul-crushing experiences as female founders trying to raise venture capital. Suffice to say the odds are not in our favor.

It felt nice to have one week where we were all doing a sanity check together and realizing that we are each other’s solution. And that while progress has felt slow, progress toward a better world is happening.

The women pictured with me above—and so many more who were there—are proof of that better world. (And, may I say, are all so accomplished that they are inspiring me to up my game!)

- Vanessa Small was one of the first in the world to create a COVID-19 test. Now, she’s working on saving the planet and making sure sustainable food tastes great (my summary, not hers). She is also a board member and investor in other women-founded companies.

- Lindsey Head is an award-winning CFO featured in Forbes and working with a variety of companies as they expand—especially women-founded companies.

- Lianè Thompson started off her career as an award-winning international journalist and pivoted to eco-preneur gathering data on the health of our water globally with an affordable fishlike autonomous underwater vehicle. She’s bootstrapped her entire company until recently (and we discovered that a fund I invested in invested in her)!

- Julie Castro Abrams is the tireless leader (even after knee surgery!) of How Women Lead, How Women Invest, and How Women Give —a network of over 20,000 women nationwide that provides programming and opportunities for women to join corporate boards, invest in women-founded companies, and learn more about making philanthropic investments or leading non-profit organizations.

- Naseem Sayani is the co-founder and managing director of Emmeline Ventures, an early-stage fund investing in ambitious female founders building businesses that are helping women manage their health, build their wealth, and live in a cleaner, safer world. She serves on a number of corporate boards and has made a number of angel investments into a variety of companies that helped her grow to found Emmeline.

This slice of women is what the summit brings together. These remarkable founders, investors, and champions who all want to make the world a better place (so many mission-driven companies!) and build the kind of wealth that frees us from obligations and enables us to back more women. That energy is something you can’t bottle, but we sure need more of it!

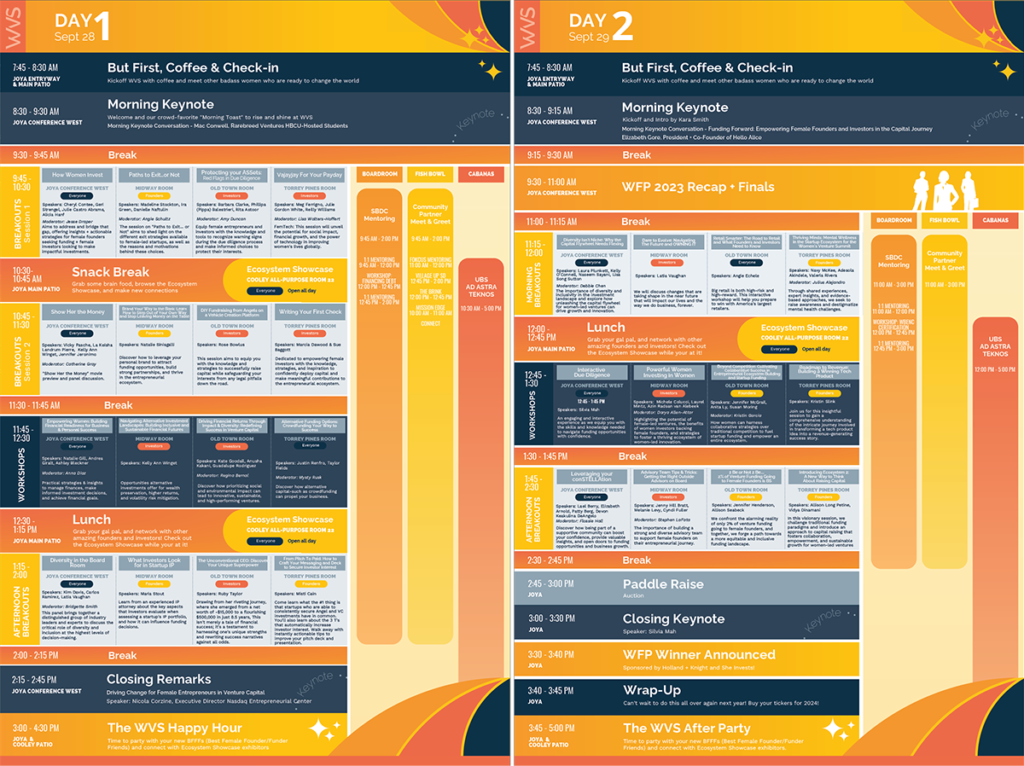

It was a two-day packed agenda:

Want to learn more about women-led funds and companies? Here are some big takeaways from the summit:

- Nearly 75% of U.S. VC firms do not have a single female investing partner. Since WVS started, there are significantly more women-run funds in venture capital, but there’s a lot of room for improvement. Women currently make up about 11% of investing partners at U.S. VC firms (Source). Initiatives like The New Table where you can find women-led funds to invest in will help.

- Women-led companies outperform their peers.

A study from Boston Consulting Group discovered that startups with a woman founder generated $0.78 for every dollar of funding, while male-founded startups generated only $0.31. Woman-founded startups also tend to exit faster and at higher values than less diverse teams. - Capital is more valuable than connections.

Too many women-founded companies are over-mentored and under-funded. Yes, you need to invest wisely (see previous bullet) so the next time a woman comes to you with a solid business—fund or startup—write a check before you write an introductory email. Connections are valuable, but capital is still the hardest hill for women to climb. Like any other founder, we need to pay our teams and ourselves while we work on building our companies. - Calling out the problem brings mixed reactions.

This is no doubt my most controversial takeaway. For so many, reading these points stirs discomfort—and not in a “we gotta fix this” way. Sometimes, exposing these imbalances motivates regressive forces. In fact, during the summit, the Fearless Fund was judicially blocked from providing $20k grants to Black Women entrepreneurs—grants which are a lifeline for Black women who get even less investment than just about all other groups. Even as I write this, Hello Alice and others who are trying to level the playing field are continuing to be attacked by those who feel like we should be happy with the scraps we have. Still, I believe that when we know better, we do better, so I’ll keep sharing the stats and beating the drum that women founders aren’t getting the support we deserve. - Women-led companies are men’s business.

The 30-year average of all-female founders’ share of VC funding is 2.4%—almost identical to the share in 2018 (2.3%)—and 2022 (1.9%). (Source) In other words, investment in women-led companies hasn’t grown in proportion to women-led funds. Women can’t be the only ones investing in women-led companies—men have to believe in the power and potential of women founders.

I share these points not to discourage you, but to motivate you—as the summit did for me in so many ways. There really is so much to be hopeful about. Here are some of the very real and lasting gifts BenchK12 and I are taking away from the 2023 Summit.

- Four new investor leads—without having to pitch. (Yet!)

- Dozens of new women founder friends and allies!

- Conversations that nourished my soul and gave us a second wind for 2023.

- A 2024 goal: to win the Women’s Venture Summit Pitch competition (I avoid pitch competitions, but I wanna win this one!)

This isn’t just a recap, but your call to action—and an invitation to next year’s Women’s Venture Summit. You can already get your early-bird priced tickets here. I would especially love to see some of our many male investors and allies there; especially if you love a room full of women cheering for you! (We loudly celebrated the men who were there in support.)

And for all of my women founder and investor sisters, I can’t wait to share this room and space with you again in 2024. I look forward to celebrating our progress and continuing to lift each other up.